DBS Announces the Addition of Trevor Johnson as Regional Sales Director for its Northwest Region

Minneapolis, MN (April 15, 2024) – Diversified Brokerage Services (DBS), a national Brokerage General Agency specializing in life, annuities, long-term care and disability insurance, has announced the addition of Trevor Johnson, CLU, CLTC as Regional Sales Director for its Northwest Region, effective April 15, 2024. Trevor will be responsible for the states of Washington, Oregon, […]

Writing a Successful Cover Letter

When an underwriting department reviews a case file, a holistic assessment is conducted which includes not only medical and lifestyle factors, but financial information as well. Consequently, a cover letter may be beneficial to help underwriters understand both the insured’s medical history and any relevant financial information. A strong cover letter should include a written […]

Underwriting Overweight and Sleep Apnea Concerns

Situation – An advisor approached DBS because their client, a 44-year-old male, was originally declined elsewhere due to his weight, high blood pressure, sleep apnea, fatty liver, and an echocardiogram that was slightly abnormal with an elevated CRP. He recently was on Ozempic and had lost 19 lbs. but because he had lost the weight within […]

Tax Implications of Code Section 1035

Situation: In another Counselor’s Corner article, we discuss how Section 1035 permits tax-free exchanges of life insurance policies. That article provided a detailed discussion of how to structure a life insurance exchange to qualify for Section 1035 tax treatment. In a nutshell, to qualify or tax-free exchange treatment under Section 1035 the transaction must be […]

Exchanging a Cash Value Life Insurance Policy Under Code Section 1035

Situation: Many modern life insurance polices contain nonguaranteed features that must be managed and reviewed. Unfortunately, while consumers are aware of the need to manage and review their investment portfolios, financial advisors may find that clients have not reviewed their life insurance policies. When a policy evaluation is finally performed financial advisors may find a […]

Underwriting Melanoma History and Alcohol Concerns

Situation – A client was tracking standard plus due to melanoma history. It was discovered through a confidential outside source that he applied elsewhere in 2018, and was postponed due to treatment for alcohol at that time. The carrier wanted to order records from the treatment facility, who advised the turnaround for records was going […]

Underwriting Psych and Substance Abuse History

Situation – An advisor came to DBS because their client was originally declined elsewhere due to her significant history in combination with her being a nurse at a treatment center and a recovering addict. The current carrier would not budge as it was a decline. DBS shopped with other carriers and got a quote; however, […]

Field Underwriting Saves YOU Time and Eliminates Surprises!

Field Underwriting is the initial gathering of medical and lifestyle information prior to requesting an application. Collecting the proper information about your client is an important step in the life insurance application process because it allows you to submit accurate and detailed answers to all questions on the application. This information also allows the DBS […]

Field Underwriting Gets More Cases Placed!

What is Field Underwriting?Field Underwriting is the initial gathering of medical and lifestyle information prior to requesting an application.Collecting the proper information about your client is an important step in the life insurance application process because it allows you to submit accurate and detailed answers to all questions on the application. This information also allows […]

Collateral Assignment of a Life Insurance Policy

Situation: Typically, this monthly publication focuses on technical life insurance concept information. However, this month we are taking a slightly different direction to describe how a collateral assignment of a life insurance policy can be used to help secure a loan from a bank or other lender. Solution: Often, when trying to get a loan […]

Trusts Used in Estate Planning

OverviewThe purpose of this brochure is to provide a general discussion of basic trust principles. It includes, for your consideration, the essential elements of trusts, their advantages, tax and nontax reasons for using them, and the various types of trusts used by individuals in their estate documents.Should You Have a Trust?Reasons for establishing trusts are […]

If You Have a Large Estate, Consider Gifting

Gifting is a valuable part of most estate plans, but when financial advisors think of gifting they usually just think in terms of the annual exclusion gift that can be made each year. The annual exclusion gift increased in 2023 to $17,000 per person, so for a couple, $34,000 can be given to a single […]

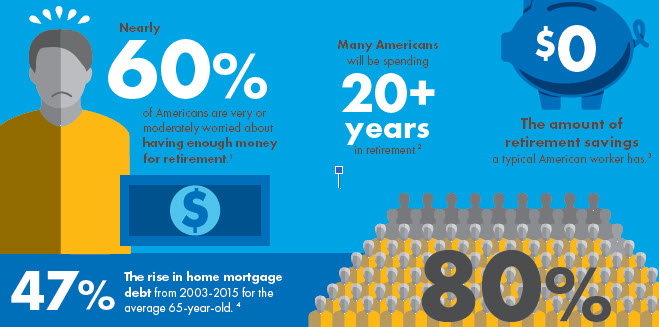

10 Reasons Why You Should Talk LTC With your Clients

Many financial professionals put off the all important long-term care conversations with their clients, because it can be uncomfortable if the client is reluctant. However, as a professional, it’s one of the most important discussions to have. If you need inspiration, here are 10 reasons why you should talk to them NOW, sooner rather than […]

4 Types of LTC Funding

No one really likes to think about needing long-term health care services, but the reality is that each year, an estimated 10 million Americans need some type of long-term care to assist them in performing everyday tasks like eating or bathing1. Long-term care expenses are a key risk to your clients’ retirement plan. If long-term […]

Men are from Mars & Women from Venus in the LTC Universe

Situation: A financial representative called her dedicated DBS Case Design Analyst with concerns about balancing the life insurance and long-term care goals of a married couple. Her client’s husband refused to attend a planning meeting to discuss long-term care, but always attended meetings in the past. The client was very interested in discussing long-term care […]

Rescuing a Life Insurance Policy with a Loan

Situation: Numerous life insurance strategies involve borrowing against the cash value of a policy. Policy loans can provide a fast and easy source of cash for clients. Often the terms of a policy loan are more favorable than a conventional loan. They do not have the stringent credit and underwriting approval requirements and the interest […]

Life Insurance as a Retirement Plan

Life insurance can offer much more than protection for loved ones. It can also help your clients achieve a variety of retirement goals including: Filling in gaps in retirement savings That may result from events such as premature death or job loss. Meeting late-retirement needs and legacy goals such as leaving assets for children or […]

LIRP Solutions

Most people think planning for retirement involves saving as much money as possible and investing it wisely by diversifying. But in addition to diversifying investments, smart retirement savers also consider how taxes will affect their retirement dollars. There are a number of ways to save for retirement and withdraw income once retirement arrives. It’s important […]

The Basics of Split Dollar

Situation: All too often when I get a call from a financial advisor contemplating an executive benefit arrangement using life insurance s/he is often contemplating either a Deferred Compensation/SERP arrangement with a delayed business tax-deduction and maximum golden handcuff, or some form of a Section 162 Executive Bonus/REBA Arrangement with an immediate business income tax […]

Help Business Owners Achieve Their Goals with Life Insurance Strategies

America’s multi-generational family-owned industries contribute $7.7 trillion annually to the U.S. gross domestic product, and family businesses are the largest private employers in the country, accounting for 83.3 million jobs, or 59 percent of the country’s private workforce. That alone makes this market a big opportunity for you, but to add to that, President Joe […]

Why Life Insurance is Often Used to Informally Fund a Nonqualified Deferred Compensation Arrangement

The changing demographics of the United States are having a profound effect on the labor supply in the nation. The population is aging, with the number of baby boomers reaching ages 65 and over expected to outnumber those ages 18 and under by 2034. (1) This is contributing to a tight labor market. At the […]

SERPs Provide Supplemental Retirement Income With Qualified Plan Limits

Have the limitations of qualified plan funding reduced the ability of your business clients to provide highly compensated executives with retirement benefits? Would your business clients be interested in providing a supplemental benefit to a select group of key executives as long as the arrangement binds the executive to the company? If so, a Supplemental […]

Business Owners Beware of Taxable Death Benefit

Many businesses own life insurance to cover losses that will be incurred at the untimely death of their owners and employees. In general, proceeds from life insurance are income tax-free under the IRC Section 101(a). However, this general rule changed when Section 101(j) was enacted as part of the Pension Protection Act of 2006. Read […]

REBAs Provide Employers with a Deductible Executive Benefit Plan with Handcuffs

In today’s business environment, executives are sometimes reluctant to participate in benefit programs where their employer’s obligation is nothing more than an unsecured promise. They have legitimate concerns about the effect that bankruptcy, buyouts, and management changes could have on future benefits. Would your business clients be willing to address these concerns if it could […]

Executive Bonus: A Deductible Fringe Benefit for Select Executives

Do you have business prospects that would like to provide a retirement benefit for their key executives, but do not want, or cannot afford, to provide retirement benefits for all employees? Do the business owners want the business to receive an income tax deduction? Do the key executives also have a need for life insurance, […]

Life Insurance Based Non-Qualified Plan Arrangements

Executive benefits enable an organization to selectively reward the key employees and executives of a business. Learn about the different options with our handy chart that outlines four life insurance based non-qualified plan arrangements. Read more in our print-friendly PDF!

Transfer-for-Value & Reportable Policy Sale Concerns in Buy-Sell Arrangements

Situation: Using life insurance as a funding vehicle for a buy-sell arrangement gives rise to several potential tax traps, especially in out-of-the-ordinary owner/beneficiary structures. It seems that more than almost any other area, buy-sell agreement funding, modification, and termination gives rise to potential transfer-for-value and reportable policy sale traps. This Counselor’s Corner discusses some of […]

Four Planning Strategies for An Uncertain Estate Tax Future

The current federal estate tax has gone through a constant stream of changes over the past few decades. There have been attempts to repeal the tax, changes to the exemption amount, and changes to the tax rates.In recent years the changes have favored reduced taxes, but this has not always been the case. During times […]

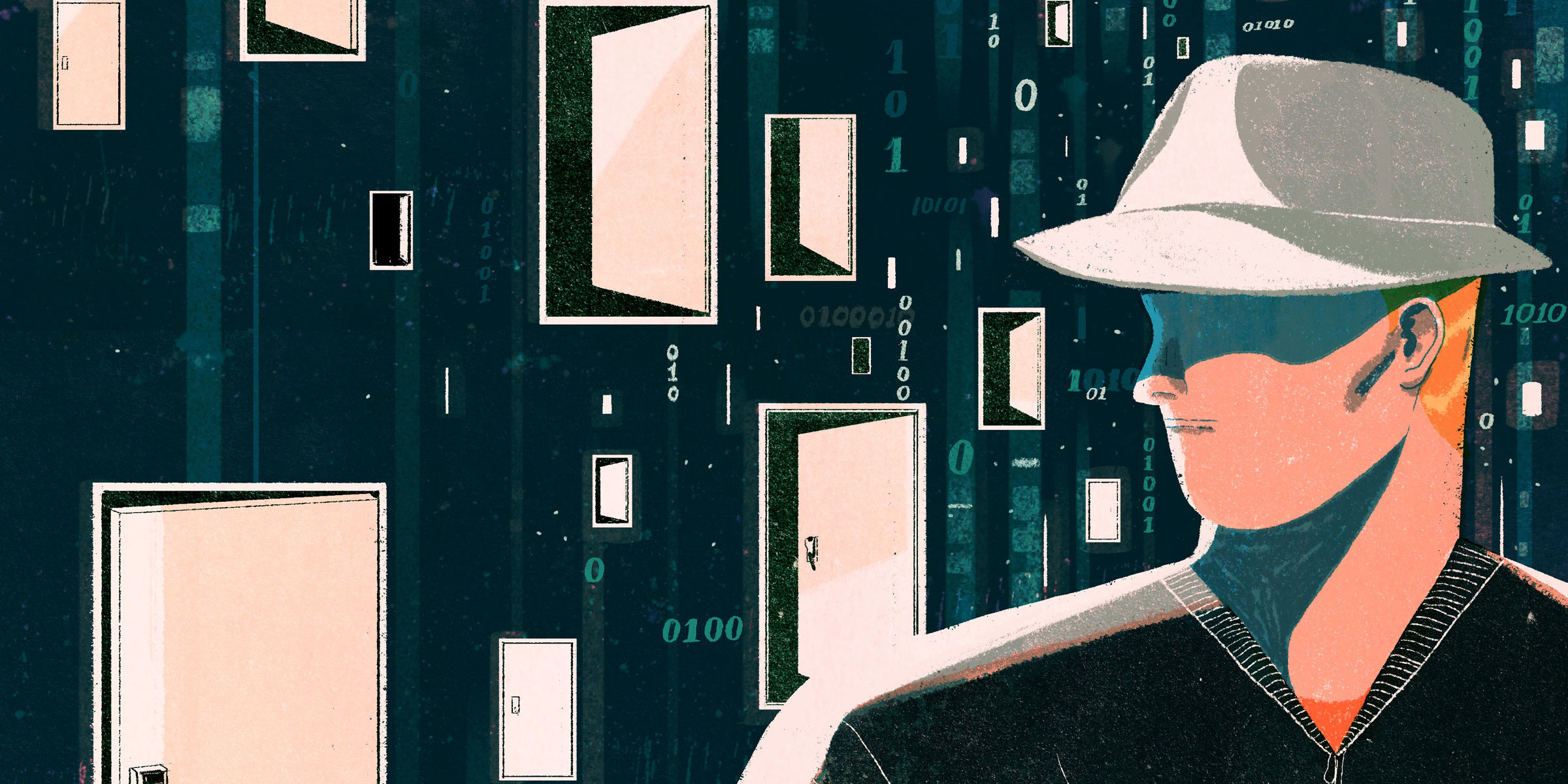

Informal Business Valuation Opens the Door to the Business Market

Business owners invest time, energy, and money to develop and grow their business. Over time the business often becomes the source of the family’s livelihood and a major portion of their estate. It’s not unusual to hear that the business is also the source of the owner’s retirement. Unfortunately, many owners don’t have a clear […]

The Many Ways to Structure a Gift Transfer

Read our print-friendly PDF version The combination of depressed market values and the historically high gift/estate exemption of $12,920,000 (2023 indexed) opens the door to significant wealth transfer planning opportunities for high net worth individuals and their families. While making a gift of an amount equal to a large part of, or all of, the […]

Key Person Coverage: A Place to Start with Business Owners

Situation: In my work with business owners, I’ve often noticed financial advisors leading with buy-sell/business succession planning. Having a succession plan in place protects the owner’s family in the event of an untimely death, but for relatively new businesses or younger business owners such a conversation may fall on “deaf ears.” Even with more mature […]

Key Person Coverage: As an Aid to Buy-Sell Coverage

One of the easiest strategies to explain and implement with business owners is Key Person coverage. The primary purpose of insuring a key person is to help the business get through potentially difficult times should a key person die. A key person can be the business owner or a valued employee. Depending on who the […]

What to do When a Loved One Dies – a Helpful Checklist

When a loved one dies, there are a number of things that must be taken care of ranging from planning the funeral, managing financial concerns, to taking care of the family pet. Even when the death is expected, it’s still a time of shock and stress, so it’s helpful to have a checklist to walk […]

Less Now or More Later? Taxes, That is…

In 2023, you can give away more… • The amount you can give away (gift exemption) without owing any federal gift tax is the highest it has ever been – $12,920,000.• However, President Biden campaigned on raising taxes and has proposed to tax the transfer of property as low as $3,500,000 at a rate of […]

NFP Acquires Diversified Brokerage Services, Inc.

NFP Acquires Diversified Brokerage Services, Inc., Expanding its Life Insurance Distribution Capabilities Acquisition adds a well-established brokerage general agency (BGA) specializing in supporting life insurance sales for financial advisors across the country NEW YORK – April 21, 2023 – NFP, a leading property and casualty broker, benefits consultant, wealth manager and retirement plan advisor, today announced […]

Quick Read – Estate Planning Flow Chart

We’ve created an easy to understand flow chart to help you understand the steps and exactly what happens during the process. Check it out now! LINK

Create an Estate That’s Equitable, and Keep Conflict Out

Treating children equally when leaving an inheritance can be an important concern for your clients, but if a large portion of their estate is a business or other non-liquid asset, they may feel like they are trying to divide the indivisible. While the inheritance they leave each of their kids might not be identical and […]

Raising Interest Rates and Legacy Planning

Situation Interest rates factor into the performance of many legacy and charitable planning techniques. Over the past several years, the historically low interest rates, and the availability of high gift and estate exemptions have provided a unique environment for certain legacy and charitable planning techniques. Specifically, in low interest rate environments grantor retained annuity trusts […]

Finding Life Insurance Opportunities Using Form 1040

A careful review of a client’s tax returns can provide insight into their insurance and financial planning needs. A review of the lines on a tax return can lead to conversations about: • Basic needs analysis and college funding • Retirement and extended care planning • Legacy & charitable planning • Business planning Additionally, comparing […]

Greenbook Deja’vu: Proposed Tax Increase on Wealthy

On March 9, 2023, the Biden Administration released its budget and tax proposals for FY2024. Alongside the Budget the Treasury released its document further describing the revenue proposals in what is typically called the Greenbook. Many of the proposals are reminiscent to those in prior years’ Greenbook. The budget proposes to increase taxes for corporations […]

Standby Survivorship Trust an Alternative to an ILIT for Insureds Desiring Control

Situation: The uncertainty of the estate tax laws has created a dilemma for many taxpayers, estate planners, and insurance professionals. Should moderately high net worth couples take action today to shelter a significant amount from estate tax (under the $12.92 million exemption) by making a large gift; or should they hold off making a large […]

Legislation Addressing Long-Term Care: An Urgent Matter

Virtually all demographic trends in the United States point to large future increases in the demand for long-term care services and support. By 2050, an estimated 27 million people will need long-term care support. The population over 65 will almost double by 2050.ii The population age 85 or older is set to double between 2015 […]

6 Reasons Women Need Long-Term Care

Long-term care planning is important for everyone, but it is arguably most important for women. Why? Longevity and caregiving. 1) Women live longer than men. Women outlive men by about five years on average. Women who are married tend to outlive their husbands. A woman born in 1960 has a life expectancy of 73 years, […]

Stretch Demise Mandates Beneficiary Review

Read our print-friendly PDF version With the passage of SECURE 2.0 and the opportunities it provides, financial professionals are reminded of the changes made in the original Act. In addition to making other changes to retirement plans and IRAs, SECURE 1.0 changed the rules on distributions for deaths occurring after December 31, 2019. Stretch Distribution […]

President Biden Signs SECURE 2.0 Legislation as Part of Spending Legislation

By Terri Getman, JD, CLU, ChFC, RICP, AEP (Distinguished) On December 29, 2022, President Biden signed into law the more than 4,000-page spending bill. In addition to funding the government to September, the legislation included provisions of what has been called SECURE 2.0. The SECURE 2.0 package is full of popular reforms that have been […]

Who Cares? You Should – The Status of State Long-Term Care

By Terri Getman, JD, CLU, ChFC, RICP, AEP (Distinguished) Situation: Public policy makers face a problem – how to pay for the cost of long-term care for people who are no longer able to take care of themselves. With the chances of needing long-term care services exceeding fifty percent for individuals turning 65 today, the […]

Linked Benefit Products: A Few Facts

Have you talked with your clients about their long-term care needs? Have the conversation today… and include a discussion of the many linked benefit options DBS has available. Read more in our print-friendly PDF!

Overcoming Objections

An objection is often just a request for more information, because remember: people are conditioned to say no. You might consider answering an objection with a question to find out why the customer objects. Sometimes customers will realize that they don’t really object; they just didn’t know they had a need. Take a look at […]

Insuring Love – Case Study

by Terri Getman, JD, CLU, ChFC, RICP, AEP (Distinguished) Situation: Periodically, an event occurs in our life that reminds us of the important role life insurance plays as a base to a sound financial plan in the lives of our customers. Recently I received a call about a young couple, who were just starting their […]

The $12 Trillion Opportunity

Situation: Typically, this monthly publication focuses on the technical side of life insurance. In honor of Life Insurance Awareness Month, we are taking a slightly different path to report on the dismal state of affairs concerning life insurance ownership in the United States. Overall, 41% of Americans say they don’t have sufficient life insurance coverage. […]

Personal Lessons Learned by a 9/11 Expert

In remembrance of the 2,977 who were killed in the 2001 September 11 attacks I thought it appropriate to write about an article that appeared in the New York Times in 2015, written by Kenneth Feinberg, the expert who decided how much should be paid to individual victims and their families. The lessons he personally […]

Will a Business Owned Buy-Sell Life Insurance Policy Increase the Value of a Descendant’s Business Interest?

Situation: One of the chief concerns for owners of a closely held business is what will happen to the business if one of the owners can no longer continue. Surviving owners generally want to ensure a continuity of ownership and management without having the departing owner’s successor thrust upon them. Disabled or deceased owners want […]

Case Study – Business Insurance

A situation recently came across the desk of our advanced planning attorney that illustrates the distinct DBS advantage: we have the advanced resources that work for you and your clients! SITUATION A business owner wanted to set up a deferred compensation plan funded with life insurance for three people involved in the business but 2 […]

Diversified Brokerage Services Announces AppVantage

Diversified Brokerage Services Announces AppVantage, an Application Fulfillment Service to Simplify Life Insurance Sales for Advisors Minneapolis, MN – Diversified Brokerage Services (DBS) has launched AppVantage, a new life insurance application fulfillment service that gives financial professionals an easy, streamlined approach for their life insurance sales. AppVantage differentiates itself from other application fulfillment platforms in […]

A Business Does Not Need to Die At the Death of a Key Employee

Read our print-friendly PDF version Businesses are born when the market has a need and someone has a great idea for meeting the need. A product or service is developed and offered to the public. Over time, the skill, knowledge, leadership, and experience of the business’s key people make it possible for it to grow […]

Owner and Beneficiary Designations on Buy-Sell Arrangements

CASE STUDY Situation: One of the most frequent questions posed to DBS’s in-house Advanced Marketing Attorney by financial representatives concerns the appropriate owner and beneficiary designation of a life insurance policy for a business buy-sell arrangement. Frequently, business owners want their business paying the premiums and they mistakenly believe that this means the business needs […]

Don’t Let Splitting the Business Split the Family

In many family-owned businesses, the commitment and contributions the children make is not equal. Sometimes this is because the older siblings come into the business earlier and carve out their place. They are often resentful of younger siblings who enter the business later expecting to be treated equally when they haven’t “earned their stripes.” Sometimes […]

NonQualified Executive Benefit Arrangements

DBS wants to stand by its goal of making life insurance easy and more profitable for YOU, the advisor. That’s why we’ve created a number of tools and resources to help you better understand the topics. Take a look at our comparative summary of life insurance-based executive compensation plans for a better understanding of the […]

Private Split Dollar as a Buy-Sell Premium Payment Strategy

Situation: Financial advisor called DBS concerning a situation involving a family business where only one of the owner’s three adult children was involved in the business. As is typical with business owners, a significant portion of the owner’s estate was the value of the business. The advisor was struggling with how to provide an “equal” […]

DBS Announces the Addition of Mike Cronbaugh to its External Sales Team

Diversified Brokerage Services (DBS) is excited to announce that Mike Cronbaugh has joined the team as a National Insurance Specialist, effective Monday, July 11, 2022. Mike will be reporting to Chuck Anderson, National Sales Director, and will be working with RBC advisors and sales desk personnel, presenting planful insurance solutions for RBC clients. “We are […]

What Are the Most Popular Life Insurance Based Nonqualified Plans?

The post-COVID resignation boom has brought employee retention issues to the forefront. With turnover rates on the increase business owners are keenly aware of how difficult it is to attract and retain key personnel. The competition for superior technical, managerial, and executive talent is so fierce today that business owners are constantly faced with finding […]

Key Person Coverage: A Simple Concept with Underwriting Challenges

The hardest part in working with business owners is getting them to set aside time to talk about their life insurance. However, once the business owner agrees to meet with the financial professional, the next most difficult challenge may be determining the face amount of coverage and then getting the insurance carrier to issue the […]

Key Employee Life Insurance Checklist

Read our print-friendly PDF version The purpose of key employee life insurance coverage is to help indemnify a business for the loss of a key employee’s skills and experience in the event of the death of that person. Death benefits or cash values may be used to help recruit and train a replacement, to pay […]

Recent Modifications to Required Minimum Distribution Rules for Lifetime Distributions

Situation: Financial representatives know that clients who own IRAs or participate in qualified retirement plans must take distributions from their accounts according to the required minimum distribution (RMD) rules. The RMD rules mandate the timing and minimum amount an IRA owner and retirement plan participant must distribute both during life and after his/her death. Clients […]

Joel Johnson Retiring after successful career

On May 2nd, Joel Johnson, CLU, ChFC, Field Relationship Manager for the North Central Region at DBS, is retiring after 17 years of exceptional service with DBS. Since mid-March, the team at DBS has been focused on making plans for the advisors and brokers currently working with Joel to ensure they are in good hands […]

DBS Announces Strategic Partnership with Kalamath Consulting Group

DBS announced a strategic partnership with Kalamath Consulting Group (KCG) at its 2022 National Sales Meeting held this past March. As part of the arrangement, KCG’s Cary Fry and Fletcher Brown are now collaborating with the DBS Sales Team to help educate and provide in-depth support for financial advisors who specialize in providing solutions for […]

DBS Welcomes Kevin Laing as new Enterprise Relationship Manager

DBS is very pleased to welcome Kevin Laing as its new Enterprise Relationship Manager, effective Monday, March 14, 2022. Kevin will be reporting to Kurt Fasen, LLIF, LUTCF, DBS Sales & Marketing Executive and is responsible for both cultivating and growing existing accounts as well as attracting new relationships at the national account level. Kevin […]

Multi-Generational Estate Planning for Uninsurable Individuals

THE SITUATION A financial professional called DBS seeking estate planning advice for a very wealthy widow. The client had previously used most of her estate tax exemption and was still in good health . . . that is for a person 87-years old. THE PROBLEM Carriers have a maximum issue age which for most carriers […]

Will there be an Estate Tax Problem if a Couple Establishes Reciprocal ILITS?

Situation: Today, moderately wealthy couples are increasingly worried about the future lower Federal exemption amount. To keep the life insurance proceeds outside their estate, we often suggest that their life insurance be owned by an irrevocable life insurance trust (ILIT). Many of those clients purchase life insurance because of the long-term care or chronic illness […]

Case Study – Strategy for Uncertain Estate Tax Environment

Read our print-friendly version here Situation:A producer contacted DBS’ in-house advanced case design resource to discuss an insurance structure for a couple in their late 40’s with $8 million net worth. The producer noted that the net worth was less than the current joint exemption ($24.12 million), but more than the prior exemption which is […]

Consider Life Insurance as an Asset in a Diversified Portfolio

Life insurance is generally thought of in terms of protecting loved ones in the event of premature death. While this is an important aspect of life insurance, it’s only part of the story. As an individual’s career flourishes and resources allow for personal investing and long-term financial planning, life insurance may be an ideal component […]

Could 2022 be an Important Year for Retirement Planning?

Situation: Clients might come away in a panic if they have been following the headlines in recent years on the question of America’s retirement savings. The prediction of doom comes from several sources. First, according to the Social Security trustees, the Old-Age and Survivors Trust Fund is forecast to become insolvent by 2034, at which […]

Why Addressing Long-Term Care is an Urgent Matter

Virtually all demographic trends in the United States point to large future increases in the demand for long-term care services and support. By 2050, an estimated 27 million people will need long-term care support. The population over 65 will almost double by 2050. The population age 85 or older is set to double between 2015 […]

Life Insurance and the Pandemic

One of the themes we’ll explore in 2022 is “LIFE Goes On,” an examination of the pandemic’s continued effect on the life insurance industry. Since early 2020 we have seen numerous changes to products and pricing, along with a shift in the way business is conducted, with an acceleration in the creation and adoption of […]

Could this be the Year to Sell Your Concentrated Stock Position?

A hallmark of wise planning is to diversify risk across a range of assets and asset types because any one asset or asset class might underperform in a given year. Diversification can help offset underperformance. This risk can be magnified when an individual has a heavy concentration in one stock or asset. While capital gain […]

Many Provisions Dropped from Build Back Better Act Proposal

The recently released House version of the Build Back Better Act dated October 28,2021 eliminates several of the previously proposed tax increases impacting high net income individuals. The tax proposals dropped in the rewrite will inevitably undergo further revisions before they’re passed by the House and taken up by the Senate.

Year-End Planning Checklist

The end of the year is the perfect time to review financial plans with your clients. This year, many wealth planning strategies are on the chopping block and high-income earning individuals could see their tax rates increase in 2022. Therefore, potential changes should be considered when making decisions. As the end of the year approaches […]

Is it Possible to Fund a Buy-Sell Agreement with a Personally Owned Policy?

Situation: Nearly all buy-sell agreements that use life insurance as a funding vehicle do not have the business owner owning their own policy. In an entity purchase arrangement (where the business buys back/redeems a departing owner’s interest), the business is the owner and beneficiary. In a cross purchase arrangement (where the remaining owners purchase interest […]

Now is the Time for Key Person Coverage

Situation: A financial professional contacted DBS’s in-house advanced case design resource to brainstorm when to approach business prospects that had expressed an interest in discussing supplemental executive benefit arrangements for key employees. Prior to COVID-19, the financial professional ran a successful telemarketing campaign focusing on mid-sized corporations. The campaign specifically promoted executive benefit arrangements that […]

Own Your Own Policy Buy-Sell

Nearly all buy-sell agreements that use life insurance have one thing in common: The business owners do not own the life insurance policies that insure their own lives. In an entity purchase arrangement, the business owns the policy. In a cross-purchase arrangement, the other owners or another entity own the policies. Common Concerns Expressed by […]

Business Uses Of Life Insurance

There are six key ways in which life insurance may benefit your business Business Transfer: Businesses or business owners can execute a buy-sell agreement and fund it with life insurance. A buy-sell agreement is an arrangement for a business to continue in the event of the owner’s death, disability, retirement or early withdrawal from the […]

Where a Child Desires Long-Term Care Coverage on a Parent

We’re focusing this month on Life Insurance and Family, with a special focus on generational planning. A recent case shows how the DBS team works for YOU to create solutions! Situation: An adult child desired to purchase a life insurance policy with a longterm care or chronic illness feature on his elderly mother to help […]

A Million to a Billion, in Three Generations…Tax Free

The Generation Skipping Transfer Tax (GST tax) is an extra tax on gifts or bequests from grandparents to grandchildren (or lower generations) that would otherwise skip successive gift or estate taxation. The GST tax rate is a flat 40% regardless of the amount of the transfer or the donor/testator’s gift or estate tax bracket. The […]

SLAT: Is It Possible to Have Access to Trust Assets Without Estate Inclusion?

Situation – With the amount sheltered from estate tax (exemption) at a historic high of $11.7M ($23.4M for a couple), many high net worth households are looking for opportunities to minimize their federal or state death tax exposure by gifting assets during their lifetime. By gifting assets when the exemption is high, a high net […]

Irrevocable Life Insurance Trust Checklist

Medical Inquiry Where a trust has not yet been established it is possible to begin the medical underwriting process with the insurance carrier by submitting what is often referred to as a “trial application.” The purpose is to verify insurability. Premium should not be collected at this point. Since premiums are not collected the insured […]

The 7 Steps to Gift Transfers

Given the amount that an individual can give away without incurring gift taxes is at a historic high and the prospect that in the near future this amount could decrease significantly many of your high net worth clients may be considering significant lifetime gifts this year. There may never be such an opportunity again, but […]

The Four Levels of Gifting

Level #1: Transfers Not Subject to Tax There are several transfers that fall outside federal gift taxation. You can make the following transfers without facing a gift tax: Anything given to a U.S. citizen spouse as long as the transfer qualifies under the marital deduction1 Donations to qualified charitable organizations made in a manner qualifying […]

Overcoming Common Client Objections to the Long-Term Care Discussion

Most people think that unpleasant things like serious illness are more likely to happen to others than to themselves. As a matter of fact, most Americans believe they won’t need long-term care, even though the U.S. Department of Health and Human Services estimates that 70% of all individuals turning 65 will need some form of […]

Life Insurance During Retirement

The conventional wisdom among investment advisors is that if clients have planned appropriately, they will not need life insurance in retirement. It is commonly thought that upon reaching retirement, they will be free of debt, have plenty of assets on hand to replace lost income and leave to heirs as a legacy. This sounds like […]

Create a Legacy Recovery Plan

While so many aspects of people’s financial lives have been shaken, life insurance continues to do exactly what it was designed to . . . serve as the foundation of a family’s financial security. While the value of many other financial assets have slipped, the death benefit of term life policies has remained the same, […]

Transfer Tax Basics for Noncitizens

Over the past few months, there has been a renewed interest in estate planning topics. The increased interest is likely due to the combination of the daily coverage of deaths due to COVID-19, historic high federal exemption amount, and low-interest rates. Recently, some of my calls involved the application of U.S. estate tax laws to […]

5 Ways to Make the Most out of Life Insurance Awareness Month

September is Life Insurance Awareness Month (LIAM), a nationwide effort put on each year by LifeHappens, a nonprofit organization dedicated to raising awareness about life insurance to help more families get the protection they need. You can celebrate with us — and boost your sales numbers in the process. Here are 5 great ways Take […]

Sales Solution – Stabilizing a Client’s Legacy

Do you have clients whose assets have lost value as a result of the recent turmoil in the markets? Are some of these clients concerned that the losses will be detrimental to their wealth transfer plans? Are you aware that NOW you can help restore your clients’ wealth transfer plans by using life insurance death […]

Want to Improve your Client Relationships? DBS Can Help!

Your relationship with your clients is more than “just business.” Clients look to you to provide guidance on financial matters, including the amount and type of life insurance that is appropriate for their unique situation. This week, we’re sharing some key strategies and ways you can build relationships with clients. Plus, we recommend some product […]

Options When the Policy is Ready but the Trust Is Not

Read our print-friendly PDF version Situation: The recent outbreak of the Coronavirus has caused many people to think about their own mortality, causing a surge in estate planning and the purchase of life insurance. As a result, we are receiving a renewed interest in one of the most common estate planning techniques – that of […]

LTC in Retirement

The Necessity of Long-Term Care in Retirement Planning When helping their clients formulate plans for retirement, financial advisors must now account for life expectancies into the early 90s. However, the simultaneous need for long-term care planning isn’t accounted for nearly as widely as it should be, considering the significant impact that long-term care expenses can […]

Long-Term Care Underwriting

Underwriting long-term care risk is very different from life insurance underwriting, and it all comes down to mortality vs. morbidity. Long-term care underwriting looks at morbidity risk, which takes into account medical impairments that impact a client’s ability to perform daily living activities which would indicate a need for long-term care. Life underwriting, on the […]

The Long-Term Care Talk

The Importance of Planning for Long-Term Care Medical advancements have made living a long, fulfilling life a near certainty – and planning for that is a necessity. Health-related expenses can increase considerably with age, especially in the face of health problems requiring long-term care. When families don’t sufficiently plan for long-term care, they may find […]

Paying For Long-Term Care

Let’s face it: people are living longer than ever before. This increased life expectancy means that chances are high that many of your clients will be impacted by a chronic illness or an event requiring long-term care. Because of this, you need to prepare them financially. Continue reading our print-friendly PDF here.

It’s Time to Change the Focus of ‘Buy Term, Invest the Difference’ Arguments

If you have spent much time listening to financial pundits, you are probably familiar with the phrase “buy term and invest the difference”. This hotly contested concept has been widely discussed in the financial industry for years.1

Are premiums on a Key Person Policy Deductible? This and Other Common Questions Answered

Situation: When the financial future of a business is dependent on the specialized skills, knowledge, or influence of a person or persons, the business should seriously consider acquiring insurance to help cover its potential loss at the death of such employee. Such insurance coverage is usually referred to as key person life insurance. A key […]

Business Insurance Checklists

The hardest part in working with business owners is getting them to purchase the life insurance they need. However, once the buying decision is made, the next most difficult challenge may be getting the insurance carrier to issue the amount applied for. Packaging the case is critical, particularly when large amounts are being requested. The […]

Business Insurance – Case Study

We’re focusing this month on various business strategies as part of our quarterly theme Let’s Get Down to Business. A situation recently came across the desk of our advanced planning attorney that illustrates the distinct DBS advantage: we have the advanced resources that work for you and your clients! SITUATION A business owner wanted to […]

Consider the No-Sell Buy-Sell Strategy

Building a successful business is not an easy task. Often, entrepreneurs and their families place personal needs second to business demands during the start-up and growth years. As the years pass, the business begins to appreciate, with prosperity just around the corner. However, the untimely death of the entrepreneur may mean that rewards never materialize […]

Key Person Facts at a Glance

Oftentimes, the most valuable assets of any business are the key people who contribute most to its success. They generate revenue, handle major responsibilities and have a unique wealth of knowledge that seems irreplaceable. Help your clients consider the amount of time and money it would take to replace their top talent. If their loss […]

Post Tax Reform Business Planning: Pass-Through Business Entities

One of the most significant and confusing provisions of the 2017 tax legislation is the qualified business income (QBI) deduction for pass-through business entities. Pass-through businesses account for about 95% of U.S. businesses and include sole proprietorships, partnerships, LLCs and S corporations. So, the impact of the legislation is significant and likely impacts most financial […]

Business owner clients present unique planning opportunities

The business market has unique planning consideration, and the fact is, many business owners have failed to get their “ducks in a row.” Take a look at the statistics we’ve compiled that show the opportunity that exists for this client type. Contact DBS for help with all the different approaches and solutions! Read the print-friendly […]

Will your clients have enough for retirement?

A number of “what if’s” can happen to your clients as they reach retirement, but you can help ensure they have enough to last through the end of their golden years. Check out this consumer approved flyer that will help get the conversation started! Read the print-friendly PDF flyer. Click here!

Women and Life Insurance: Where are the Opportunities?

This article is available as a print-friendly PDF handout. Click here! Women today represent a diverse and multifaceted segment of the financial planning marketplace. In fact, women account for 85% of all consumer purchases.1 Furthermore, today’s women are highly educated and more financially empowered than ever before. However, evidence suggests that their financial planning needs […]

Life Insurance Retirement Planning for Women

This article is also available as a print-friendly PDF handout. Click here! We’re focusing this month on retirement planning with life insurance, and we’re examining how the strategies pertain to women. The numbers are clear: women face greater challenges when it comes to retirement planning, and their wants and needs are unique. The DBS Case […]

Are your female clients facing a retirement readiness gap?

This article is also available as a print-friendly PDF handout. Click here! By Terri Getman, JD*, CLU, ChFC, RICP, AEP (Distinguished) Americans are not prepared for retirement – and it’s no secret that women face greater financial challenges in retirement than their male counterparts. Generally, women earn less than men, are more likely to work […]

The 12 Million Dollar Illustration

How much in new assets under management would you need to bring in to generate $100,000? We break it down for you and show the benefit of incorporating life insurance into your practice. Click here for the full-color, print-friendly PDF.

Keys to Building Better Relationships

History matters, and each of your clients has been uniquely shaped by the eras in which they’ve matured. A Baby Boomer will not respond to the same sales tactics as a Millennial, and vice versa. A one-size-fits-all approach to life insurance sales will ultimately fit no one. So this week, we bring you the strategies for selling […]

Risks of the Trade

Hey, guess what!? This article is also available as a print-friendly PDF handout. Click here! By Terri Getman, JD*, CLU, ChFC, RICP, AEP (Distinguished) The Facts: This story starts many years ago at a charitable ball where an advisor met a wealthy business owner. Over time, the advisory relationship with the business owner grew. A […]

Considerations of a Policy Review

Hey, guess what!? This article is also available as a print-friendly PDF handout. Click here! By Terri Getman, JD*, CLU, ChFC, RICP, AEP (Distinguished) Situation: Many client’s life insurance policy portfolios are a mess. According to LIMRA, more than 60% of U.S. life insurance policy owners don’t know what they have or why they purchased […]

10 Reasons to Reopen an Underwriting File

Hey, guess what!? This article is also available as a print-friendly PDF handout. Click here! Lori-Anne Walker, our in-house Chief Underwriter, oversees the Underwriting Team and coordinates the advanced underwriting services that DBS provides. Having worked in the insurance industry for many years in a variety of roles, Lori has the experience, knowledge, and intuition […]

Policy Review Success Stories

Hey, guess what!? This article is also available as a print-friendly PDF handout. Click here! We’re focusing this month on the importance of life insurance policy reviews. Conducting regular performance evaluations for your clients is an easy way to connect and get a good overall picture of their financial situation. It gives you an opportunity […]

Is it Time for a Life Insurance Review?

For many, life insurance is their largest unmanaged asset. Far too often, policyholders go many years without having their life insurance policies reviewed – much to the detriment of their portfolios. While you may assume that clients aren’t interested in visiting you for a policy review, they need to at least be given this option. […]

The Business Transition Process: Breaking it Down Into Easily Manageable Steps

Business transition planning for a closely held business is necessary because eventually, an owner will leave the business in one way or another. Regardless of the way in which an owner departs, a business faces the likelihood of liquidation without proper planning. Under such circumstances, the result is usually a forced sale at fire sale […]

Life Insurance & Special Needs Planning

Although the recent tax legislation has temporarily reduced the importance of estate tax planning for everyone except the ultra-wealthy, it did not obviate the need to make estate plans for non-tax reasons. These non-tax estate planning concerns are especially magnified for families who have members with special needs. It is imperative for guardians of a […]

Collateral Assignments for Loan Indemnification

Situation: This monthly publication traditionally focuses on technical life insurance concepts. However, this month we are taking a slightly different approach. In this article, we will discuss how the collateral assignment of a life insurance policy can be used to help secure a loan. Solution: Lenders will often require life insurance to secure a […]

It’s Time to Review Your Client’s Group Life Coverage

A DBS associate recently reminded me that we are entering the time of year when many will be selecting their group benefits. This makes it the perfect time to review your clients’ group life options. In fact, there are many reasons why it may be beneficial for your client to purchase an individual life insurance […]

The Importance of Inforce Policy Illustrations

According to LIMRA, more than 60% of U.S. life insurance policy owners don’t fully understand what policies they hold, why they were originally purchased, or how they are currently performing. When it comes to life insurance holdings, the unknown can be risky and underperforming policies may be in danger of future lapse. If your client […]

Financial Justification: The Other Underwriting Hurdle

Situation: A financial representative called DBS seeking coverage for two very healthy married insureds, both medical students. The male insured had approximately $200,000 of student loans, and the female $100,000. The male expected to graduate and start his residency in a year, and at a starting pay of $45,000. The female took leave from medical […]

7 strategies for repurposing life insurance policies

We’ve advised readers in the past against dropping existing life insurance policies simply because of the temporary increase in the estate tax exemption. Instead, now is the time to review existing policies, possibly simplify techniques or repurpose its use. Not sure how? Here’s a list of seven strategies for repurposing existing life insurance.

Murder She Wrote: Will a carrier pay a claim if an insured is murdered?

The topic for this post reminded me of the television crime drama series from the 1980-90s “Murder, She Wrote,” which revolved around the daily life of Jessica Fletcher, a successful mystery writer, who proves to be better at solving murders by carefully piecing together clues. Researching this issue provided some fascinating reading – as interesting […]

Having trouble with the life insurance conversation?

If you are like many financial advisors you spend much of your time focused on helping clients build wealth for important goals while minimizing portfolio risks. Unfortunately, too few spend time addressing non-portfolio risks that can prevent clients from reaching those goals. When you do this, you’re missing an aspect of risk management that can affect […]

How to Navigate the Life Insurance Conversation

Completing a thorough fact finder is important and necessary in order to do the best job possible for your clients. Equally important is asking the right questions. How you open the conversation and what you ask can lead to a deeper understanding of a client’s financial concerns.

How to Identify Clients with a need for Life Insurance

As a financial professional you already know why investing is important. You can build an investment portfolio whose design is to accumulate dollars toward every goal a client has. It can be creative, tax-efficient, and even leave your clients with a comfortable lifestyle as they save toward their life goals. But what happens if the client dies prior […]

Timing is everything – don’t wait to get your cases placed!

It’s natural for a client to put things off; there always seems to be more time until there is no time. It’s up to you as the advisor to keep things moving toward completion. Here’s a recent case that started out like most, but in the end came down to a matter of weeks before […]

Make “People” Review part of your Life Insurance Policy Review Process

For many individuals life insurance is their largest unmanaged asset. Unfortunately, after a policy is purchased it often is put in a drawer and not looked at again until a death claim is filed. Like an investment portfolio a life insurance policy portfolio should be reviewed every couple of years or at a minimum when […]

The critical practice for an advisor: regular portfolio reviews

As a financial advisor you are well aware of the need to manage and review investment portfolios, but you may not understand how important it is to manage and review your clients’ life insurance policies to ensure they are continuing to meet their objectives. Many Life Insurance Product Features Must be Managed Modern life insurance policies […]