Men are from Mars & Women from Venus in the LTC Universe

Situation: A financial representative called her dedicated DBS Case Design Analyst with concerns about balancing the life insurance and long-term care goals of a married couple. Her client’s husband refused to attend a planning meeting to discuss long-term care, but always attended meetings in the past. The client was very interested in discussing long-term care options, however her husband had no interest in participating.

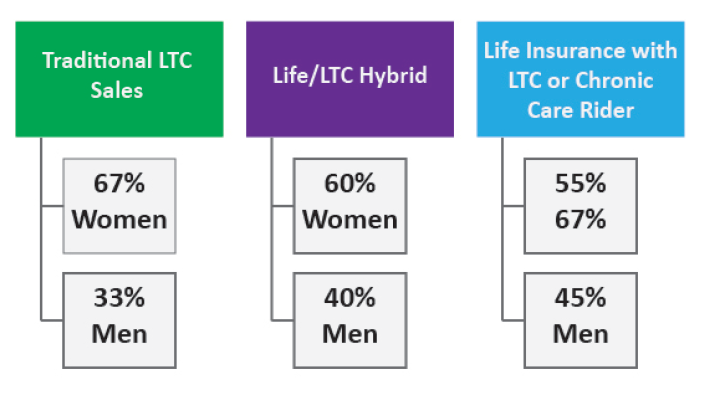

Problem: When it comes to interest in long-term care, numerous studies indicate that women are far more concerned about planning for their longterm care needs than men.

Solution: The DBS Case Design Analyst told the financial advisor that her experience is very common, but that studies also reveal a way to overcome that resistance. If you look at the studies more in-depth, you will see that women tend to focus more on product designs that provide the most long-term care benefit and gravitate toward traditional and asset-based designs. Men, on the other hand, tend to lean toward product designs where the primary benefit is death benefit (see chart). The IRR on the death benefit for a life insurance policy with a long-term care or chronic illness rider was seen more favorably by men, helping to overcome the concern of potentially wasting money if they don’t use the long-term care/chronic care feature.

Based on this information, the financial advisor designed a presentation where she proposed a Lincoln MoneyGuard policy for the wife and a Prudential no-lapse guarantee variable policy with a “Benefit Access Rider” (Prudential’s chronic illness rider) for the husband. The husband and wife liked the different approaches, and the case was sold!

Lesson: Don’t assume a married couple will respond the same to the same linked benefit approach. A custom, combined solution may be the best way to bridge the gap and satisfy both parties while ensuring all long-term care needs are met.